The key factors that influenced trading on global financial markets

2025 was defined by dramatic shifts and surprising outcomes across global investment markets.

From the surge in precious metals to the resilience of equities and the evolving landscape of fixed income, investors navigated a world shaped by economic uncertainty, technological innovation, and shifting government policies.

Here are five key themes that defined investing in 2025.

1. International markets take centre stage

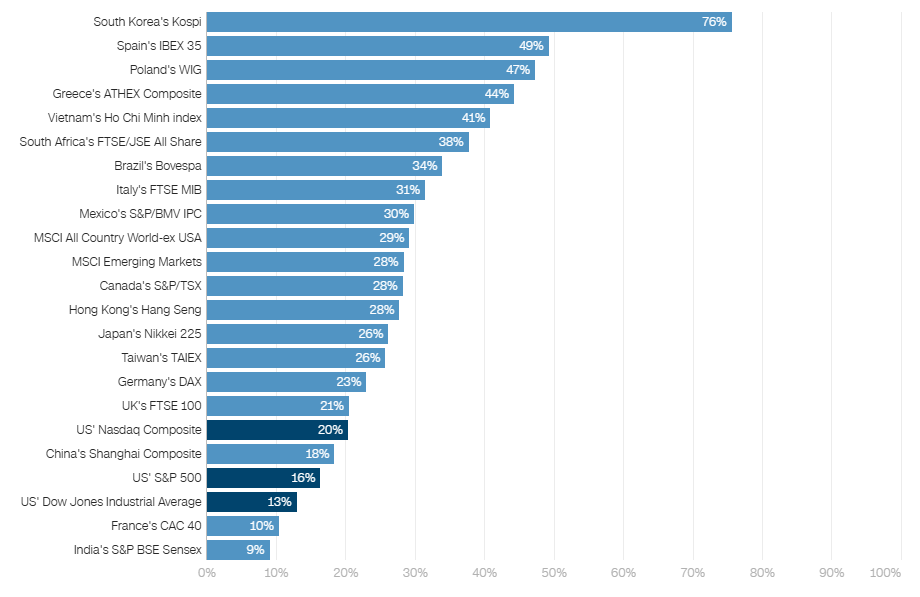

Despite a turbulent start – marked by tariff scares, ongoing wars, a government shutdown in the United States, and persistent inflation – global equities ended the year with robust gains. Among other things, the equities rally was powered by resilient corporate earnings, interest rate cuts, and continued enthusiasm for artificial intelligence. But the best equities market returns were not from the U.S. While the S&P 500 Index surged to record levels, returning over 16% excluding dividends, and the technology heavy Nasdaq gained around 20%, many international developed markets outperformed U.S. stocks, with the MSCI All Country World Index up over 21%. South Korea’s Kopsi index was the strongest performer, gaining an impressive 76%. Spain, Poland, Greece and Vietnam all posted gains above 40%. By contrast, Australia’s S&P/ASX 200 Index posted a much more modest gain of 6.80% for the year (excluding dividends).

International stocks outperformed US indices in 2025

Annual percentage gain for benchmark stock indices around the globe, in 2025

Note: Annual gains are rounded to the nearest percentage point. Returns exclude dividends.

Sources: Factset, CNN

2. The U.S. dollar’s decline and global diversification

The U.S. dollar fell more than 9% against major currencies, its worst performance since 2017. This decline boosted returns for international assets and reinforced the rally in gold. Developed markets outside the U.S.—notably Europe and Japan—delivered some of the strongest equity returns, with Japan’s Nikkei 225 up 26% and Germany’s DAX up 23% (see chart above). Emerging markets also performed well, led by India and Brazil, as investors sought growth and diversification beyond the U.S.

3. AI, tech, and the broadening of market leadership

AI continued to dominate headlines and drive investment flows, but 2025 saw a shift from hype to deployment. While the largest tech companies remained market leaders, the benefits of AI began to spread to other sectors—especially data storage, semiconductors, and industrials. This broadening of market leadership was a healthy sign, suggesting that future gains may come from a wider set of companies and industries. At the same time, investors became more selective, focusing on earnings resilience and shareholder yield.

4. Fixed income: A return to relevance

After years of low yields, fixed income made a comeback in 2025. Central banks around the world diverged in their policies—The U.S, Europe and the UK continued to cut rates to support growth, while Australia’s Reserve Bank paused its easing cycle. This divergence created opportunities for active investors. The Morningstar US High Yield Bond Index returned over 8%, while emerging market debt benefited from stronger growth and lower default rates. Investors were compensated for inflation risk, with fixed income offering attractive yields and risk-adjusted returns, especially as equity-bond correlations normalised during the year.

5. Precious metals stole the show

Gold and silver were the undisputed growth stars of 2025, with both precious metals reaching record levels. Silver soared 140% by year end, while gold posted gains of more than 60% to over US$4,300 per ounce. This rally was driven by a mix of geopolitical tensions, central bank buying, and strong demand from both retail and institutional investors. The metals also benefited from their dual role as safe havens and, in silver’s case, as critical industrial inputs for solar panels, electric vehicles, and data centres. Investors flocked to gold and silver ETFs, seeking diversification and protection against currency weakness and policy uncertainty.

Notes:

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Diversification does not ensure a profit or protect against a loss.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966). The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia.

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2026 Vanguard Investments Australia Ltd. All rights reserved.